IRA to Add More Solar, but 2022 Forecast Downgraded

By Christian Roselund

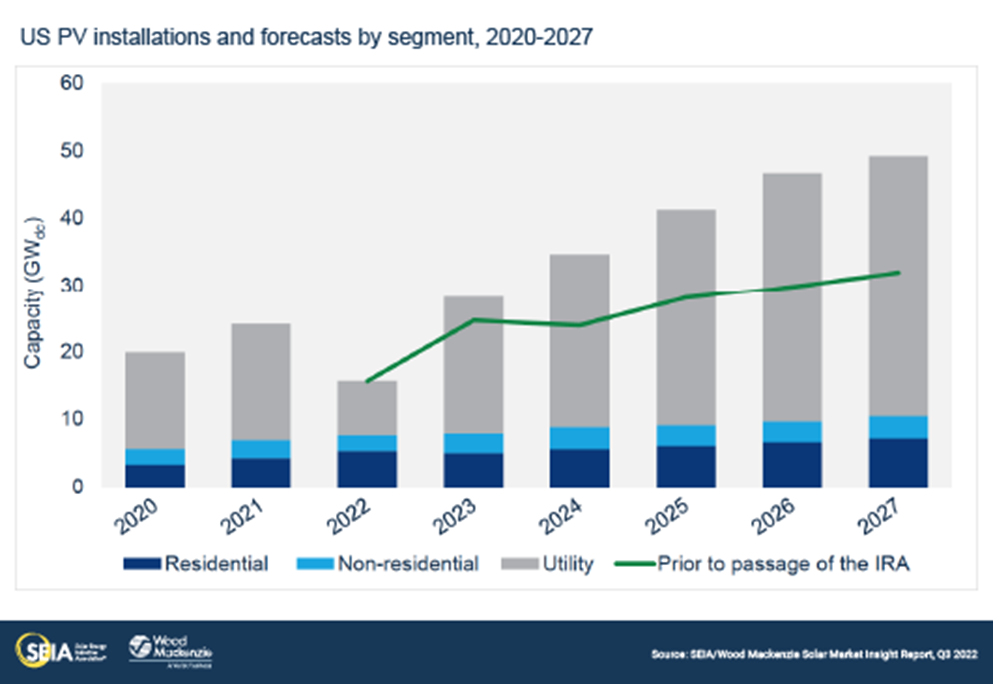

Wood Mackenzie and Solar Energy Industries Association (SEIA) have increased their forecast of U.S. solar deployment from 2022 through 2027 by 40% over their previous outlook in response to the passage of the Inflation Reduction Act (IRA). This change represents 62 gigawatts-DC of additional solar capacity. However, the two organizations have also quietly downgraded their 2022 solar installation forecast to 15.7 gigawatts, its lowest level since 2019.

Analysts at Wood Mackenzie note that the 10-year timeline of investment tax credit (ITC) extensions under the IRA is far greater than the previous 2- and 5-year ITC extensions. Michelle Davis, principal analyst at Wood Mackenzie and lead author of the report notes that this gives the U.S. solar industry the most long-term certainty in terms of incentive levels that it has ever had.

However, near-term module supply is anything but certain. SEIA and WoodMac had previously increased their installation forecast for 2022 to 18 gigawatts-DC following a 2-year suspension of duties under the anti-circumvention investigation. They have now dropped it back down to 15.7 gigawatts, citing the detention of solar modules under the Uyghur Forced Labor Prevention

Act (UFLPA).

UFLPA creates near-term challenges

The UFLPA was implemented in June 2022. The law creates a rebuttable presumption that goods made wholly or in part in Xinjiang, China, are made using forced labor and thus cannot be imported into the United States. Polysilicon was identified in the law as a priority area of enforcement, and as of 1 September, 2022, Customs had detained $393.6 million worth of PV modules under the law. CEA estimates that this represents 1.1 gigawatts of solar PV.

These detentions compound the existing supply shortage which has existed since mid-2021, after module shipments were detained by Customs under the withhold release order (WRO, an import ban) on Chinese metallurgical grade silicon maker Hoshine Silicon.

One of the challenges has been long uncertain timelines for release of detained product, under both the WRO and UFLPA. In early September, Customs released a shipment of JA Solar modules detained in June 2022 during the final days of the Hoshine WRO. However, to CEA’s knowledge, none of the modules detained under UFLPA have yet been released.

SEIA and Wood Mackenzie estimate that UFLPA could limit solar deployment through 2023 due to constraints on available modules. The organizations note that this pushes the near-term effectiveness of the IRA out to 2024.

Uneven deployment during Q2 2022

SEIA and Wood Mackenzie estimate that 4.6 gigawatts-DC of solar was installed during the second quarter of 2022, down 12% from the second quarter of 2021. However, installation volume trends vary widely by segment. The organizations find that the residential segment set another quarterly record with 1.36 gigawatts installed, while commercial solar was down a modest 7% year-over-year to only 336 megawatts.

In sharp contrast, installations in the utility-scale segment fell 25% year-over-year to 2.7 gigawatts-DC. This segment has experienced the brunt of the industry’s trade policy challenges, as it relies on imported modules, whereas the residential and commercial markets can be supplied by domestic modules. These U.S.-made modules Most of the domestic supply of U.S. modules are produced for the residential and commercial cost more to manufacture and are sold at a higher price to less price-sensitive markets.

SEIA and Wood Mackenzie also estimate that average PV system prices increased $0.07 to $0.27 per watt from Q2 2021 to Q2 2022, depending on the market segment. Most of the price increases resulted from the above-mentioned supply shortages and resulting higher module prices driven by trade policies, but the organizations also note that high polysilicon prices played a role.

Source: U.S. Solar Market Ready for Rebound after Tumultuous First Half of 2022 (SEIA)