Energy Dept. Provides $2.8 Billion to Boost Battery manufacturing

By Anjali Joshi

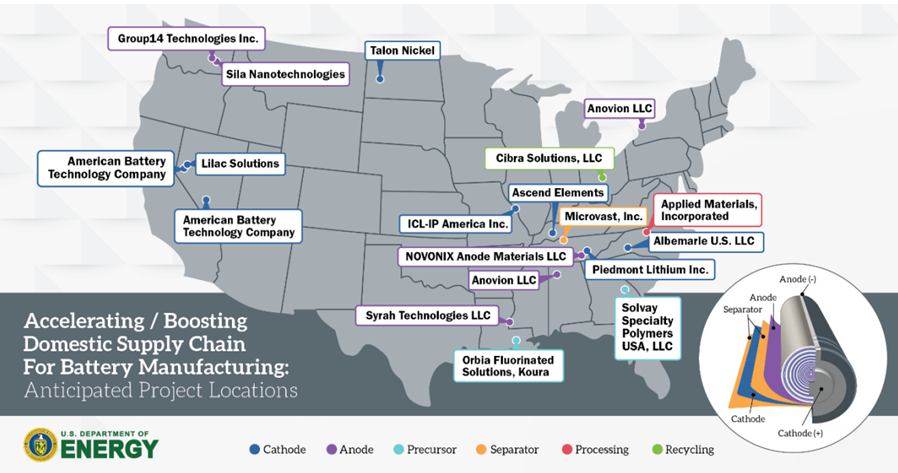

On 19 October 2022 the U.S. Department of Energy (DOE) announced billions in awards to support and develop the domestic manufacturing of batteries for both EV and electrical grid applications. Using funding made available through the 2021 Infrastructure Investment and Jobs Act, DOE awarded $2.8 billion to 20 battery manufacturing and battery material processing companies for different projects across 12 U.S. states across the nation.

Awardees were selected on a competitive basis from over 200 applicants in a process which opened in February 2022. The funding is intended to boost the production of different battery materials across the supply chain, which includes:

- Development of battery-grade lithium to produce around 2 million EVs annually

- Development of battery-grade graphite to produce around 1.2 million EVs annually

- Development of battery-grade nickel to produce around 400,000 EVs annually

- Construction of the U.S. first large-scale, commercial lithium electrolyte salt (LiPF6) production facility

- Construction of an electrode binder facility which will supply 45% of the anticipated domestic demand for binders for EV batteries in 2030

- Construction of domestic silicon oxide production facilities to supply anode materials for around 600,000 EV batteries annually

- Construction of the first domestic lithium ferrous phosphate (LFP) cathode facility

Currently, almost all battery-grade raw materials – lithium, graphite, nickel, cathodes and anodes, electrolyte salt, and electrolyte binder – are produced abroad, with China controlling the major share of global capacity for raw material refining, cathode and anode materials preparation, and cell production. The absence of domestic mining, processing, and recycling capacity in the United States leaves the domestic EV and BESS sectors dependent on foreign supply chains, which have at times been unreliable. Since this could hinder the development and growth of the EV and BESS sectors in the country, the U.S. government has started taking measures to support the development of a stable and secure domestic battery supply chain.

Major Mining Companies to Receive Funding

Following are some of the major awardees:

- Albermarle Corp – The lithium company received $149.7 million to build a lithium separation & processing facility in Kings Mountain, North Carolina, that uses spodumene minerals from the site’s lithium mine. The plant is expected to process 2.7 million tons per year of spodumene ore, enough to power 750,000 electric vehicles.

- Piedmont Lithium – Piedmont was awarded $141.7 million to build a lithium processing facility in Tennessee. The plant is expected produce 30,000 metric tons per year of lithium hydroxide for the domestic battery market, when it becomes operational in 2025. Piedmont is likely to initially process ore sourced from Quebec and Ghana as its plans to build a lithium mine in North Carolina have faced strong opposition.

- Talon Nickel (USA) LLC – Received $114.8 million in funding to construct a battery minerals processing facility in Mercer County, North Dakota. The plant is likely to process nickel ore extracted from its planned underground mine in Minnesota.

Ascend Elements – Received $316.2 million in funding to set up the country’s first commercial-scale metal extraction and precursor cathode active material production facility, using critical cathode materials recovered from spent lithium-ion batteries. The company will use its proprietary Hydro-to-Cathode direct precursor synthesis process technology at its Apex facility in Kentucky.

- Syrah Resources – Received $219.8 million in funding to set up a new 11,250 metric ton per annum anode active material (AAM) production facility in Vidalia, Georgia, using natural graphite from the Balama graphite mine in Mozambique. Once operational in Q3 2023, the facility will be the only large-scale natural graphite AAM producer outside China, and the first large-scale natural graphite AAM producer in the United States.

- Microvast – Awarded $200 million to build a separator facility which will supply 19 gigawatt-hours (GWh) of EV batteries. The company’s 2 GWh battery plant in Clarksville, Tennessee is already under construction.

Although the funding supports projects of different mining companies including Albermarle, Piedmont Lithium, and Talon Metals, the program does not mention any initiative or measure to alleviate permitting delays faced by companies in the U.S. mining industry. This is likely to hamper the development of these mining projects.

Launch of the American Battery Materials Initiative

At the same time, President Biden also announced the American Battery Materials Initiative, which aims to coordinate the government’s efforts in securing a stable and sustainable supply of critical minerals used for EV and electrical grid batteries, while strengthening national security and creating good-paying jobs across the battery supply chain. DOE will lead this initiative and with the support from the Department of the Interior aims to align different programs and efforts taken across the federal government, including the Infrastructure Investment and Jobs Act and Inflation Reduction Act, to support the growth of the domestic battery supply chain.

Source: Biden-Harris Administration Awards $2.8 Billion to Supercharge U.S. Manufacturing of Batteries for Electric Vehicles and Electric Grid (U.S. Department of Energy)