U.S. Solar, Wind Installations Collapse in Third Quarter

By Christian Roselund

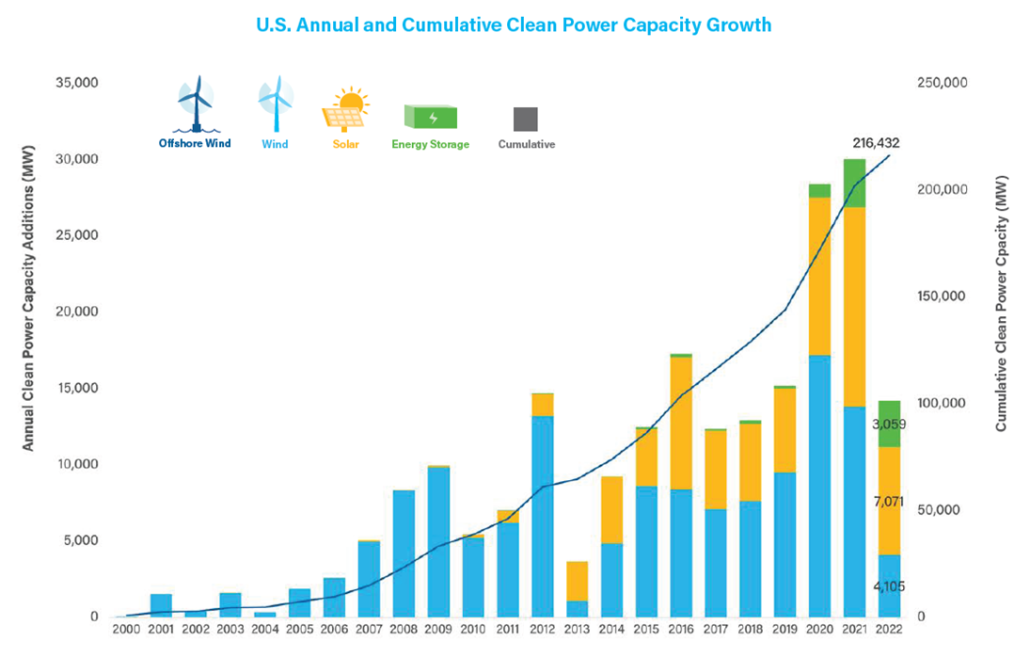

Q3 2022 was the slowest quarter for solar and wind installations that the United States has seen in three years, according to a report by American Clean Power Association (ACP). The Clean Power Quarterly Market Report finds that the United States installed only 1,877 megawatts-ac of solar and 356 megawatts of wind during the quarter, attributing this slowdown to a combination of policy and supply chain challenges. However, the report also finds that 1,195 megawatts / 2,774 megawatt-hours of battery storage was installed, and that 2022 is looking to be yet another year of growth for the battery storage market.

For solar, the 1,877 megawatts-ac installed is a 23% decline year-over-year, and the smallest quarterly volume since the third quarter of 2020. The first two quarters of 2022 also saw depressed installation volumes, and only 7,071 megawatts have been installed during the year to date. Even with a strong fourth quarter, it would be essentially impossible for solar installations to catch up and reach the level installed in 2021.

ACP cites an inability to source PV modules as the main cause of the slowdown in solar installations, noting that both the withhold release order (WRO) on Hoshine Silicon and detentions under the Uyghur Forced Labor Prevention Act (UFLPA) have limited module supplies.

It is unclear when UFLPA detentions will be resolved. U.S. Customs officials detained modules from at least three major suppliers (Jinko, LONGi, and Trina) starting in late June 2022. Despite the detention of more than 1,000 shipments of PV modules, CEA has only in the last week learned of the first release of a detained solar shipment. And beyond the direct impact of detentions, UFLPA has also caused suppliers to divert modules away from the U.S. market. In its recent quarterly results Jinko estimated that over the full year 2022 it will have deferred shipping roughly 2,000 megawatts of PV modules that were intended for the United States.

For wind, only two projects came online during the second quarter with a total capacity of 356 megawatts, a 78% year-over-year decline. ACP says that this slowness was expected, and attributes this to the phase-down schedule of the Production Tax Credit prior to its re-instatement at $15 per megawatt-hour (adjusted for inflation) under the Inflation Reduction Act. However, the organization also notes that “lingering supply chain challenges” and delays in interconnection approval also played a role.

Many of the solar and wind projects that did not come online in the third quarter may be installed in future quarters. ACP estimates that 14,167 megawatts-ac of wind, solar, and battery projects were delayed beyond the third quarter; after nearly 20 megawatts were delayed in the second quarter. ACP counted 36,240 megawatts of projects that were delayed at the end of the third quarter.

The only sector that saw installation growth in the third quarter was battery storage, where the 1,195 megawatts coming online represents a 227% growth over the third quarter of 2021. In the first three quarters of 2022, 3,059 megawatts / 7,952 megawatt-hours of battery storage have been installed.

Solar, wind, and battery storage have healthy pipelines, with 22,543 megawatts of wind, 78,181 megawatts of solar, and 14,265 megawatts / 36,965 megawatt-hours of battery storage under development. However, given trade policy challenges and increasing delays in interconnection approval, it is unclear when all this capacity will come online.

Source: Clean Power Quarterly Market Report Q3 2022 (American Clean Power Association)