By Anjali Joshi

Long-duration energy storage (LDES) technologies are likely to play a vital role in helping the United States achieve its energy system modernization and transition to a clean energy economy. LDES systems offer stable energy output, ranging from 10 hours to days or weeks or even seasons, and provide enhanced grid reliability compared to short-duration energy storage systems.

Several U.S. states have set energy storage targets to meet their climate and clean energy goals. New York aims to deploy 6 GW of energy storage on its networks by 2030 in response to its Climate Leadership and Community Protection Act. The state has set a target to increase the share of renewables in its electricity mix to 70% by the end of this decade. However, these targets typically do not specify the duration of storage, and the overwhelming majority of the energy storage deployed in recent years has been 2- and 4-hour lithium-ion batteries.

New York has taken steps to remedy this, and on 8 September announced US$16.6 million in funding for five LDES projects through the New York State Energy Research and Development Authority (NYSERDA). The state committed a further US$17 million for advancing the development and demonstration of different LDES technologies through a competitive funding opportunity. The funding aims to support the development of non-lithium-ion battery LDES technologies- hydrogen, thermal, electrochemical, and mechanical- due to safety concerns regarding the use of lithium-Ion battery storage in and around building in the state. The state has placed a heavy emphasis on hydrogen, as three of the five projects are based on this technology.

Below is the detailed description of each of the five projects:

Nine Mile Point Nuclear Station

Awarded US$12.5 million to demonstrate long-duration hydrogen energy storage paired with peak power generation from nuclear and hydrogen. The projects aims to demonstrate the efficiency of the hydrogen energy storage unit in reducing emissions from the New York Independent System Operator (NYISO) electric grid. Constellation Energy, the leading operator of nuclear plants in the United States, plans to use heat and electricity produced by its nuclear power plants to produce hydrogen for power generation. The company’s pilot project includes the demonstration of the production, storage, and use of hydrogen produced from nuclear power through Nel Hydrogen’s 1 MW electrolyzer powered by Nine Mile Point Nuclear Station. The project is expected to come online before the end of 2022.

Borrego Solar Systems

Awarded US$2.7 million to design, develop, and construct two standalone zinc-based battery storage systems with six-hour duration of storage. The project is aimed to demonstrate the cost-competitive of zinc hybrid technology against lithium-ion. There have been speculations in the market that the technology provider could be Eos Energy Enterprises which offers the same, zinc-based battery technology solutions.

JC Solutions and RCAM Technologies Solutions and RCAM Technologies

Awarded US$1.2 million to develop a 3D printed concrete marine pumped hydro energy storage (PHES) system that integrates directly with offshore wind enhancing grid reliability and peaking power capacity.

Power to Hydrogen

Awarded US$110,000 to develop Clean Energy Bridge, a proposed technology for reversible fuel cells which can produce and store hydrogen.

Roccera

Awarded US$100,000 for the evaluation and demonstration of prototype ‘Solid Oxide Electrolyser Cell’ for clean hydrogen production that can be manufactured to scale.

Although LDES technologies have been around for a long time, most notably in the form of pumped hydro storage systems, factors like high cost, permitting issues, technological barriers, and lack of regulatory support have prevented the widespread adoption of new alternative technologies other than pumped hydro which is widely deployed.

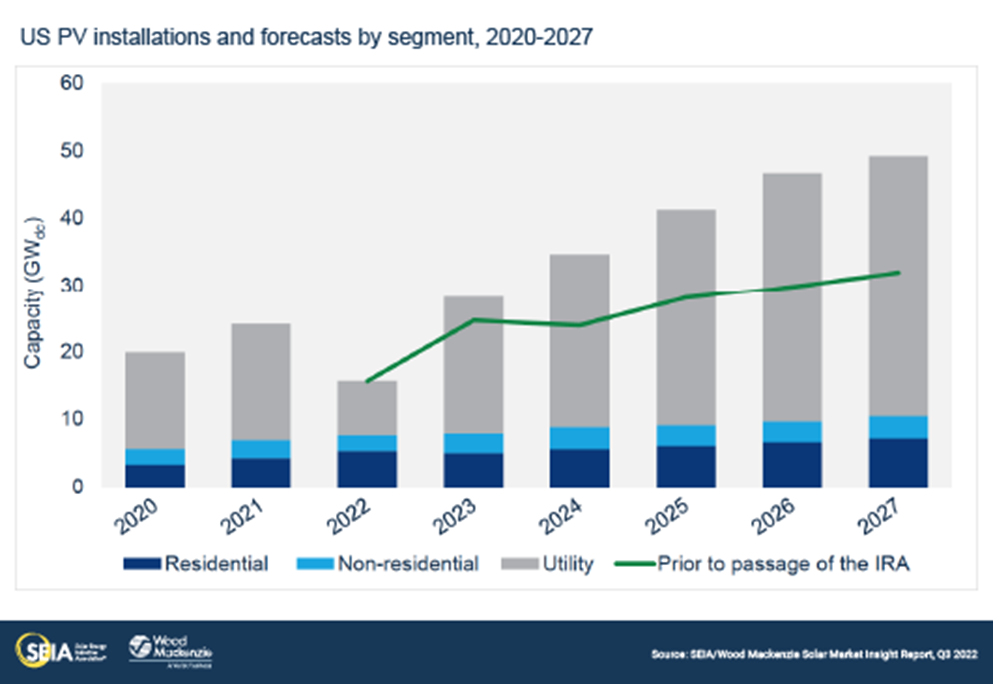

However, the demand for long-duration energy storage technologies is increasing at a significant rate as more and more renewables are being added to the grid. Cost declines in all types of storage technologies, including LDES, due to the recent inclusion of the standalone investment tax credit (ITC) under the Inflation Reduction Act (IRA) is expected to further accelerate the adoption of LDES technologies in the United States.

Source: CEA Research