Biden Orders 2-Year Exemption on Southeast Asia Solar Duties

By Christian Roselund

On 6 June, U.S. President Joe Biden invoked emergency powers to exempt solar cells and module imports from Cambodia, Malaysia, Thailand, or Vietnam from duties under the current anti-circumvention investigation for a period of 24 months. This declaration of an emergency was hailed by solar developers, installers, and the two largest solar trade organizations: American Clean Power Association and Solar Energy Industries Association. It was sharply criticized by Auxin Solar and organizations supporting its petition, as well as thin film module maker First Solar.

The United States is an import-dependent solar market and the four nations in the investigation supplied 85% of the solar module imports to the United States in 2021. Following the initiation of the investigation on 25 March, 2022 imports dried up and projects have been delayed or cancelled as developers scrambled to get their hands on modules from other nations at higher prices and less favorable terms.

However, despite this reprieve, U.S. module supply faces other policy barriers and many projects previously scheduled for 2022 are still struggling to get back on track. Wood Mackenzie estimates that without additional policy support such as extensions and expansions of solar tax credits, only 18 gigawatts of solar will be installed this year, less than in either 2020 or 2021.

CEA expects an eventual reduction in prices due to the 24-month exemption, however this price decline could be delayed and we do not expect prices to return to the levels seen before the anti-circumvention investigation was launched. Primary reasons for continued high prices are both the existing supply constraints in the U.S. market and the significant market uncertainty created by pending implementation of the Uyghur Forced Labor Prevention Act (UFLPA).

Potential Legal Challenges

Biden’s declaration of emergency is based on a clause in federal law that allows the president to suspend duties in the event of an emergency. While the examples stated are imports of “food, clothing, and medical, surgical, and other supplies for use in emergency relief work,” the law proscribes broad powers under emergency declarations for the president to act in the national interest.

In his emergency declaration, President Biden stated that the restriction on solar imports is threatening the completion of solar projects that will be needed for grid reliability this summer. This assessment is supported by the North American Electric Reliability Corporation’s recent warning that much of the nation could suffer electricity interruptions this summer driven by climate-induced heatwaves, a reduction in hydropower due to a drought in the West, and lack of available capacity (for more information see the 31 May U.S. Energy Transition Report).

Auxin Solar, which filed the anti-circumvention petition, has indicated that it is considering a legal challenge against Biden’s emergency rule. Additionally, Trade Lawyer and Law Professor Tim Brightbill, who represented plaintiffs in earlier solar trade cases, called the move “unprecedented,” and stated that “a number of parties” would be looking at the legality of the move. However, other legal experts have noted that it is difficult to challenge presidential emergency proclamations. It is especially difficult to do so when the process to do so is spelled out in the law, as it is in this case.

Supply Shortage Remains

CEA’s position is that this two-year exception to duties will not on its own resolve the shortage of modules in the U.S. market. Demand far exceeds domestic production, as the nation has only 8 gigawatts of production capacity – and only 2.6 gigawatts suitable for the utility-scale sector – compared to 23.6 gigawatts of installations in 2021.

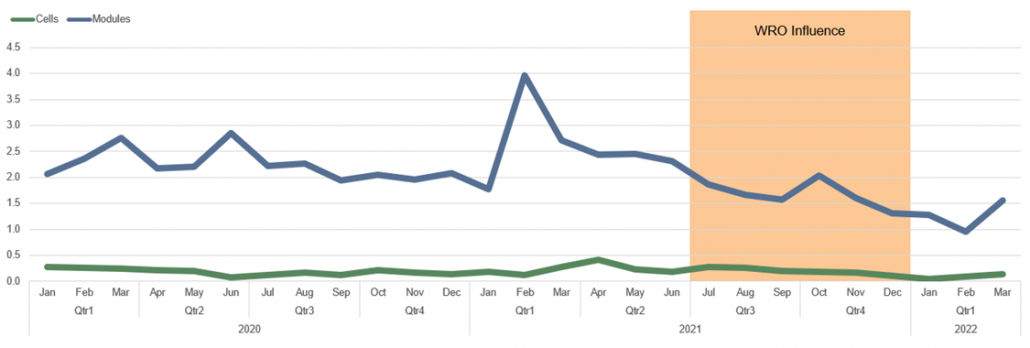

Meanwhile, the imports which have met the large majority of U.S. demand slumped in the second half of 2021 and 2022. This decline began after Customs began seizing shipments of PV modules under an withhold release order (WRO, an import ban) on product containing silicon from Hoshine Silicon. CEA estimates that this resulted in 4 gigawatts fewer modules delivered than would have been the case without the Hoshine WRO.

Additionally, the UFLPA is set to take effect on 21 June, 2022. This law creates a rebuttable presumption that materials produced in Xinjiang, China, are made with forced labor and thus any products made with them cannot be imported into the United States. Polysilicon has been identified as a priority area but many of the details of implementation will only be released on June 21.

At least one of the largest module makers in Southeast Asia is holding off on signing new contracts until it can get more clarity on how UFLPA will be implemented. The federal government’s deadline for releasing its strategy to implement UFLPA including a list of banned entities has a deadline of June 21, the same day that the law takes effect.

As such the United States solar market remains supply-constrained – a situation that may or may not be resolved after the release of the UFLPA implementation. And the prospects for domestic manufacturing to fill the market’s demand – let alone the Biden’s ambitious climate objectives – remain elusive and far off.

Read more:

Source: Declaration of Emergency and Authorization for Temporary Extensions of Time and Duty-Free Importation of Solar Cells and Modules from Southeast Asia (White House)

Source: Department of Commerce Statement on President Biden’s Proclamation on Solar Cells and Modules (U.S. Department of Commerce)