U.S. H1 SOLAR DEPLOYMENT LAGS, WIND BEATS FORECAST

By Christian Roselund

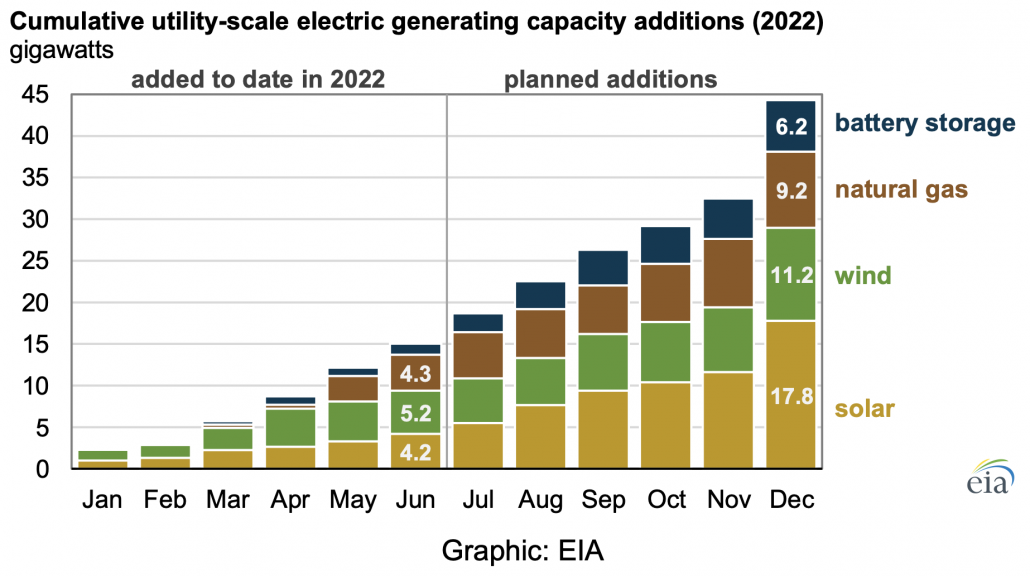

The U.S. Department of Energy’s (DOE) Energy Information Administration (EIA) reports that the United States installed 4.2 gigawatt-AC (GWAC) of solar PV projects 1 megawatt and larger in the first half of 2022. EIA currently expects only 17.8 GWAC of large-scale solar to come online over the full year 2022.

The 17.8 GWAC figure is a decline from EIA’s January estimate that the nation would install 21.5 GW of solar over the course of the year but is still larger than the 15.5 GW installed in 2021. AC figures represent delivered power to the grid, not the capacity of modules installed, and as such this 17.8 GWAC could translate to about 24 gigawatts-DC of modules installed, based on DOE’s estimated 1.34:1 DC-AC ratio for utility-scale projects.

EIA cites “pandemic-related challenges in supply chains” and the anti-circumvention investigation into solar imports from Southeast Asia as likely causes for the 3.7 GW reduction in expected full year 2022 installations. The agency did not mention the Uyghur Forced Labor Prevention Act (UFLPA) and this suggests that it may not have yet accounted for the market impacts of this policy.

As noted in the 26 July US Energy Transition Report, CEA has confirmed that three large Tier 1 Chinese solar manufacturers have had their modules detained under UFLPA. To date we have not confirmed that any of these modules have been released from detention, and one of these suppliers has temporarily stopped production at its Vietnam module factory.

Wind and Gas Installations Rise

EIA also found that 5.2 GWAC of wind was installed in the first half of the year; over the full year it expects 11.2 GW of installed wind. This is an increase from the 7.6 GW that was previously planned. However, the nation also installed 4.3 GW of natural gas-fired power plants during the first half of the year and EIA expects 9.2 GW of new gas capacity over the full year.

The United States experienced the highest monthly natural gas prices since 2008 in May at $8.12 per million British thermal units (MMBtu) and EIA expects an average gas price of $5.97/MMBtu in the second half of 2022. This is higher than for most of the previous decade and these higher prices may have an impact on new gas projects. However, the projects coming online in 2022 likely started construction two or three years earlier under very different future price expectations.

But if natural gas power plants continue to come online, the story is different for coal. During the first six months of 2022 the nation retired 6.7 GWAC of coal plants, and EIA expects 11.6 GW to retire by the year’s end.

Source: The U.S. power grid added 15 GW of generating capacity in the first half of 2022 (EIA, Today in Energy)