EIA: More Solar, Batteries to Replace Coal in 2023

By Christian Roselund

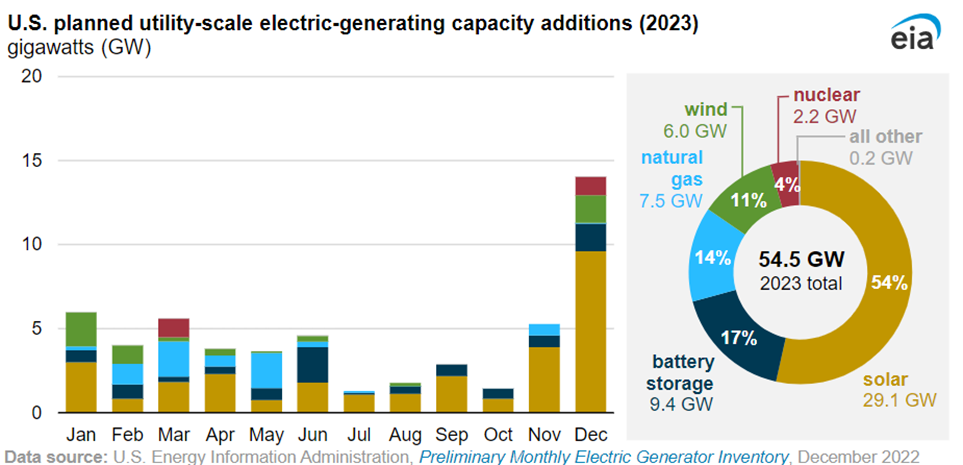

The U.S. Department of Energy’s Energy Information Administration (EIA) estimates that developers plan to install 29.1 gigawatts-AC of utility-scale solar, 6.0 gigawatts of wind, and 9.4 gigawatts of battery storage in 2023. These numbers were revealed in EIA’s January 2023 Preliminary Monthly Electric Generator Inventory, and are projected to represent 54%, 11%, and 17%, respectively, of the new utility-scale generating capacity coming online in the United States in 2023.

For the last several years solar and wind have together made up the majority of new capacity on the U.S. grid. That said, EIA estimates that utility-scale solar installations fell 23% in 2022 versus 2021 levels. American Clean Power Association and Solar Energy Industries Association attribute the declines in 2022 installation levels primarily to the effects of the Uyghur Forced Labor Prevention Act (UFLPA) and the solar anti-circumvention investigation. UFLPA detentions are ongoing and there is a danger that the United States could install much less than the 29.1 gigawatts of planned solar if developers are unable to procure modules due to detentions.

EIA estimates that Texas will lead new utility-scale solar capacity in 2023, with 7.7 gigawatts planned, followed by California with 4.2 gigawatts. Texas and California have been the largest solar markets in recent years.

and Texas.

Wind deployment has slowed in recent years, and the 6 gigawatts planned for 2023 is much less than the more than 14 gigawatts deployed in both 2020 and 2021. Among major wind projects, EIA is anticipating the 130-megawatt South Fork Wind Farm to come online off the coast of Massachusetts in 2023. The agency has not included the 800-megawatt Vineyard Wind in its 2023 capacity estimates, which could mean that the offshore wind project’s completion date has been pushed out to 2024.

In addition to the solar, wind, battery, and natural gas-fired capacity, EIA reports that Southern Company plans to put online two units totaling 2.2 gigawatts at the Vogtle Electric Generating Plant in the state of Georgia. These join the 1.16-gigawatt Watts Barr Unit 2 as the only three commercial-scale nuclear reactors that the United States has brought online in more than 30 years.

15.4 GW of Fossil Fuel-Fired Generation to Retire

EIA is projecting that 6.2 gigawatts of natural gas-fired plants, 8.9 gigawatts of coal plants, and 0.4 gigawatts of oil-fired power plants will retire in 2023. This includes 1.49 gigawatts at the W.H. Sammis coal-fired power plant in Ohio and 1.278 gigawatts at the coal-fired Pleasants Power Station in West Virginia, as well as three aging gas plants totaling 2.2 gigawatts near Los Angeles, California. Even after accounting for the 7.5 gigawatts of new natural gas-fired power plants planned for 2023, this still translates to a net loss of 8 gigawatts of fossil fuel-fired generation.

This shift from coal to renewables is driven by not only policy but the dismal economics of coal-fired power as compared to new renewable generation. A recent report by Energy Innovation found that 99% of existing coal-fired power plants in the United States are more expensive to operate than to replace with wind or solar, with a median cost differential of 50%-60%.

Source: More than half of new U.S. electric-generating capacity in 2023 will be solar (EIA, Today in Energy)

Source: Coal and natural gas plants will account for 98% of U.S. capacity retirements in 2023 (EIA, Today in Energy)

Source: The Coal Cost Crossover 3.0 (Energy Innovation)