Unternehmensumfrage: Renewables der entscheidende Standortfaktor der Zukunft

Für den Wirtschaftsstandort Deutschland ist der schnelle Ausbau erneuerbarer Energien zukunftskritisch. Zu diesem Ergebnis kommt eine Umfrage, die von der Initiative „The Transatlantic Sun&Wind Belt“ gemeinsam mit dem Meinungsforschungs-Institut Kantar durchgeführt wurde. Von Oktober bis Dezember 2022 wurden hierzu 250 Entscheider internationaler Konzerne und großer Mittelständler befragt.

Grüne Energie ist entscheidender Standortfaktor

„Wir werden definitiv keinen Standort mehr mit fossiler Energie eröffnen“

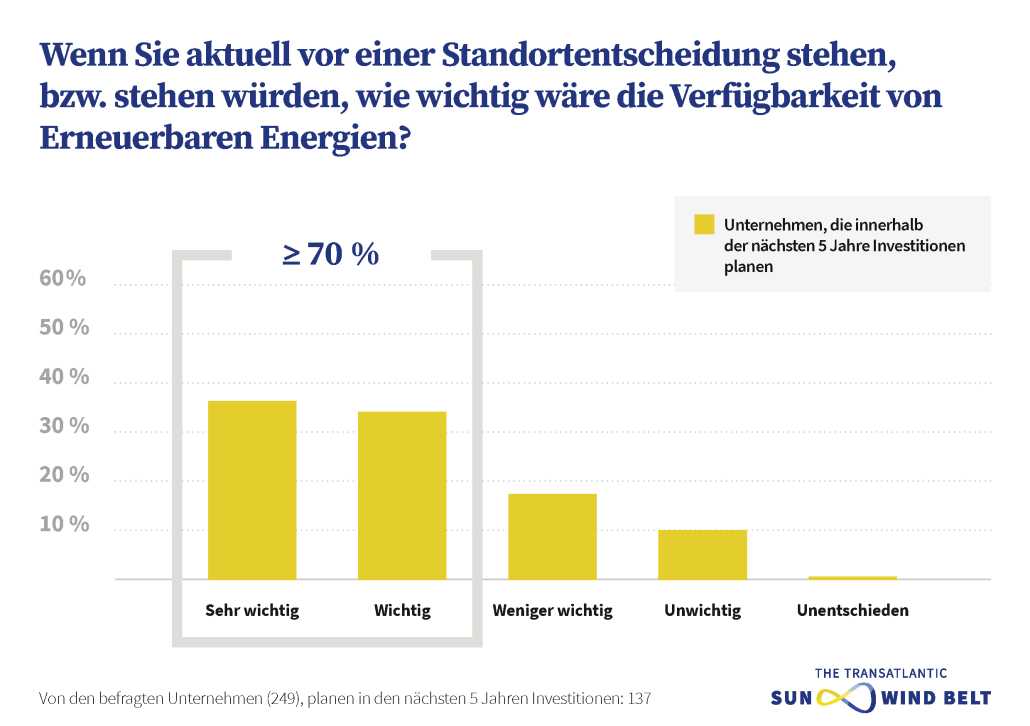

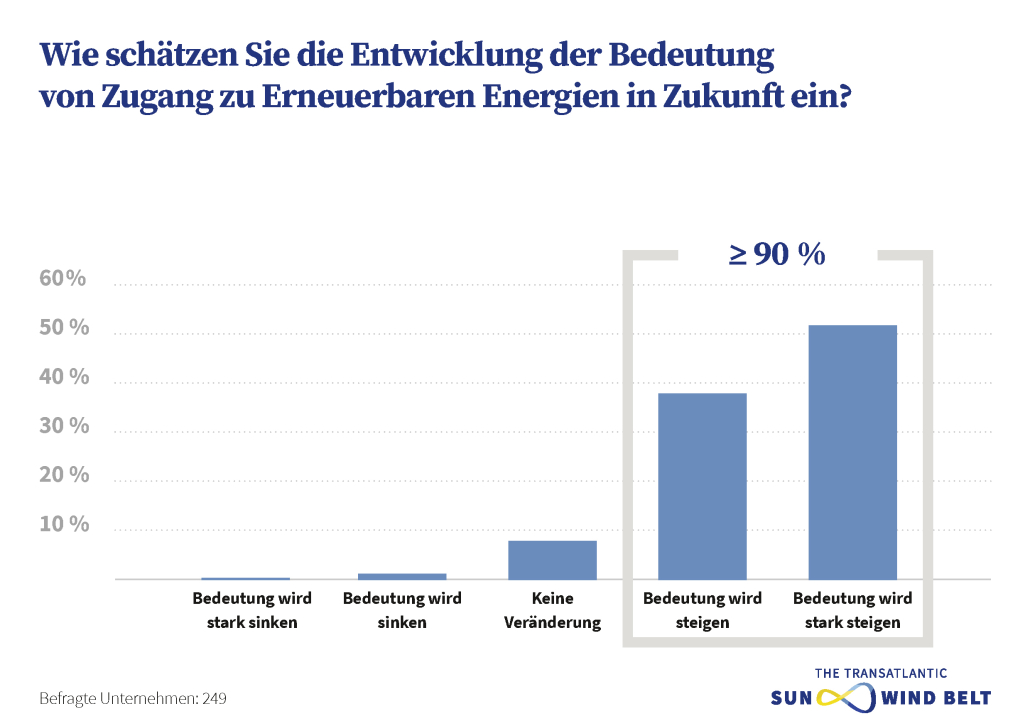

Die deutliche Mehrheit der befragten Unternehmen hält die Verfügbarkeit von grünem Strom bereits heute für wichtig oder sehr wichtig, wenn es um die Frage geht, an welchen Standorten neue Investitionen getätigt werden sollen. Bei Unternehmen, die in den nächsten fünf Jahren eine Investition planen, sind es sogar über 70 Prozent. 90 Prozent der Unternehmen glauben darüber hinaus, dass die Bedeutung des Zugangs zu Erneuerbaren Energien weiter steigen oder stark steigen wird. Als Gründe werden hierbei vor allem Wettbewerbsvorteile sowie die unternehmenseigenen Nachhaltigkeitsstrategien genannt. Klimaschonende Produkte werden von Kunden im Privat- genau wie im Industriebereich immer mehr eingefordert. Darüber hinaus haben sich die meisten Unternehmen ehrgeizige Emissionsreduktionsziele gesetzt, welche insbesondere in energieintensiven Industrien häufig nur durch den Einsatz von grünem Strom eingehalten werden können. Gleichzeitig verweisen die Unternehmen auch auf den hohen Kostendruck. Angesichts der aktuellen Energiekrise stehe die ausreichende Versorgung mit bezahlbarer Energie an erster Stelle. Die Unternehmen sehen aber auch im Kontext der Energiekrise und des Kostendrucks den schnelleren Ausbau von grüner Energie als Teil der Lösung.

„Wenn mehr Grüne Energie nutzen würden, würde auch der Preis entsprechend sinken“

„In der aktuellen Debatte wird so getan, als würden steigende Energiepreise dem Ausbau der Erneuerbaren Energien entgegenstehen. Das Gegenteil ist der Fall: Grüner Strom ist der günstigste am Markt. Um den Strompreis insgesamt wieder auf ein wettbewerbsfähiges Niveau zu bringen, ist ein schnellerer Ausbau der Erneuerbaren Energien daher die einzige logische Antwort“, sagt Milan Nitzschke, Co-Founder der Unternehmensinitiative Sun & Wind Belt.

Deutschland droht internationale Wettbewerbsfähigkeit zu verlieren

„Die Zeiten als Vorreiter sind vorbei, andere Länder haben aufgeholt und uns teilweise auch überholt“

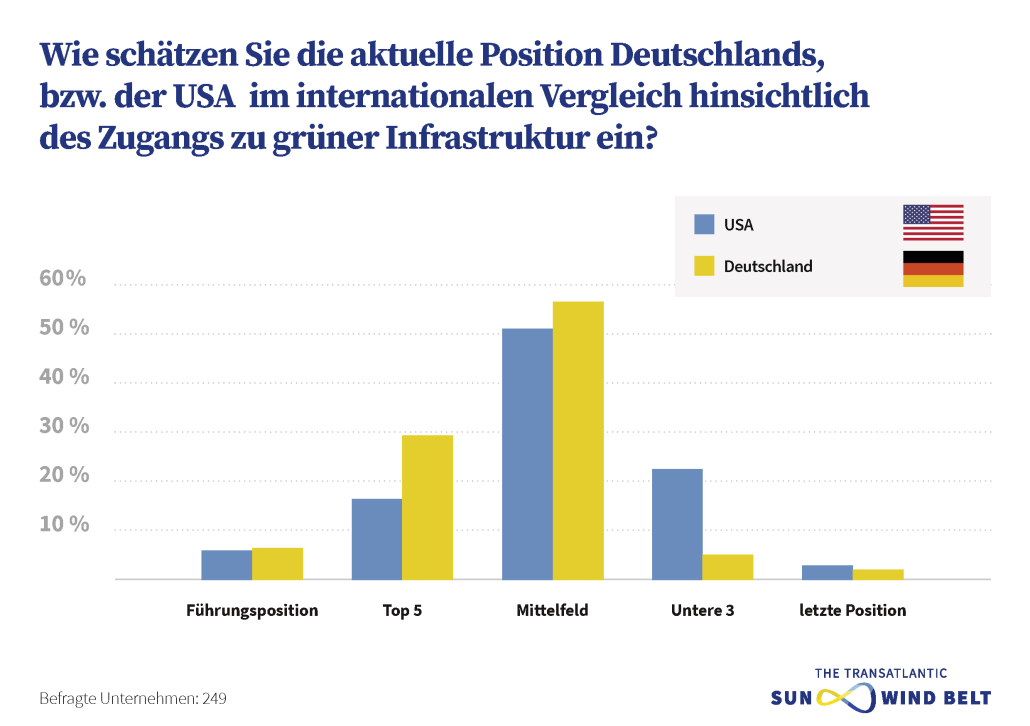

Im internationalen Vergleich sieht die Mehrheit der Unternehmen Deutschland hinsichtlich des Zugangs zu grüner Infrastruktur lediglich im Mittelfeld. Die einstige Vorreiterrolle sei durch fehlenden politischen Willen, Bürokratie und lange Genehmigungsverfahren sowie fehlende Anreize verspielt worden. Andere Länder, insbesondere in Nordeuropa, hätten Deutschland dadurch mittlerweile längst überholt. Aber auch China und Japan werden aufgrund ihrer hohen Investitionen in Erneuerbare Energien als „Leader“ genannt. Angesichts der hohen Bedeutung, die die Versorgung mit Erneuerbaren Energien offensichtlich bei Investitionsentscheidungen spielt, droht Deutschland in dieser Hinsicht international ins Hintertreffen zu gelangen. Investitionen in neue und bestehende Standorte könnten in Zukunft stärker in die Länder und Regionen geleitet werden, die besseren Zugang zu bezahlbarem, grünem Strom anbieten. Die USA werden beim Zugang zu grünem Strom aktuell noch etwas schlechter als Deutschland bewertet, dies dürfte sich angesichts der dynamischen Entwicklung in den USA jedoch schnell ändern.

„Die Unternehmen haben die günstigeren Energiepreise der USA schon seit längerem im Blick. Bisher bewerten sie diesen Standort noch zurecht als schwächer im Bereich der CO2-freien Energien. Doch das ändert sich gerade. “

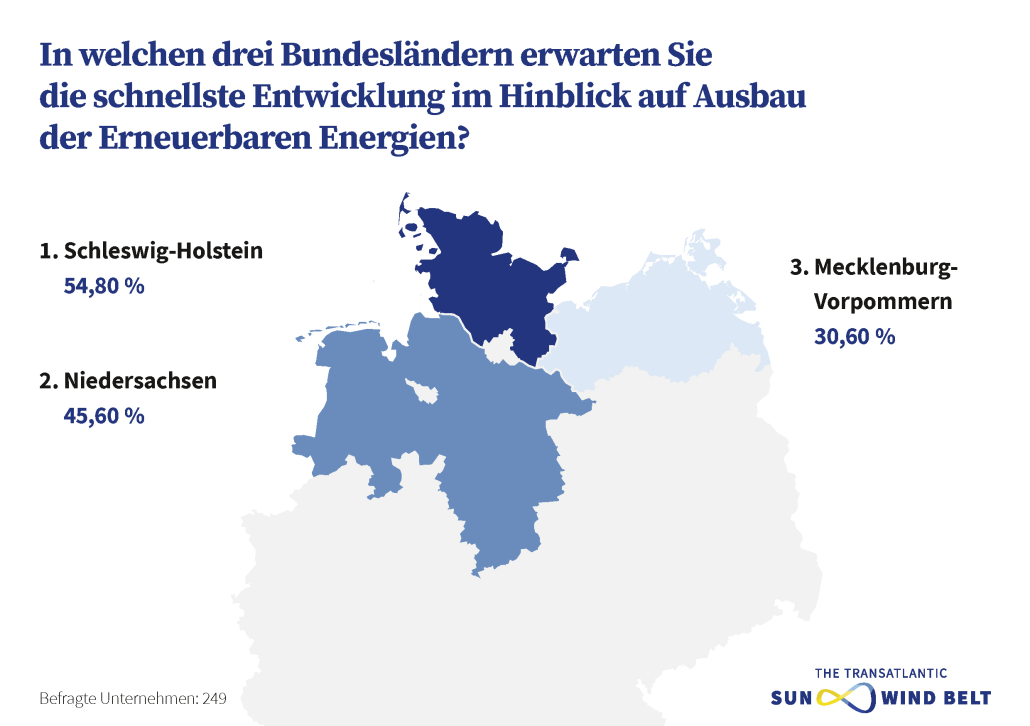

Innerhalb Deutschlands weisen die Unternehmen auf regionale Unterschiede beim Ausbau der Erneuerbaren hin. Die schnellste Entwicklung in dieser Hinsicht erwarten die Unternehmen vor allem im Norden des Landes. Die Top drei Bundesländer, die die beste Versorgung mit regenerativen Energien versprechen, sind laut der befragten Unternehmen Schleswig-Holstein (54,80%), Niedersachsen (45,60%) und Mecklenburg-Vorpommern (30,60%). Bundesländer im Süden Deutschlands scheinen das Rennen um die deutschlandweite Vorreiterposition beim Ausbau der Erneuerbaren Energien klar zu verlieren, was mittel- bis langfristig zu deutlichen Standortnachteilen führen könnte. Aktuelle Beispiele von Unternehmen, die sich bei einer Neuansiedlung eher in Richtung der Bundesländer mit gutem Angebot an grünem Strom orientieren wie Northvolt, Intel und Tesla, spiegeln diesen Trend wider.

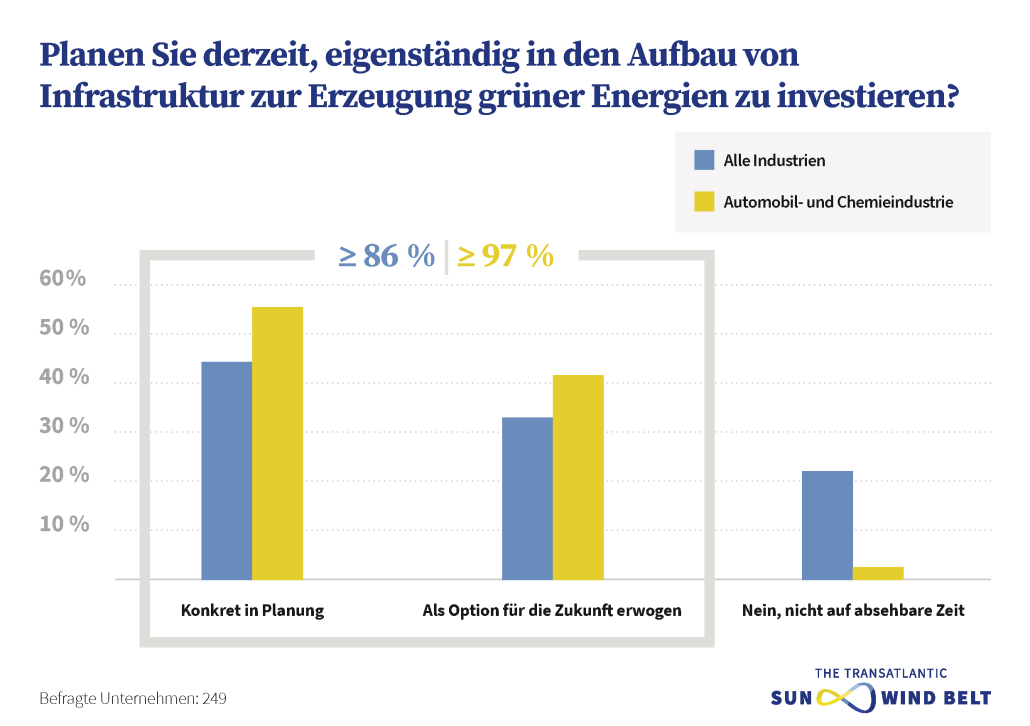

Energieintensive Industrien nehmen Ausbau selbst in die Hand

Da der Ausbau der Erneuerbaren Energien in Deutschland insgesamt nicht schnell genug vorangeht, werden mehr und mehr energieintensive Unternehmen selbst aktiv. Über 40 Prozent der befragten Unternehmen investieren laut eigenen Angaben selbst in den Aufbau von Infrastruktur zur Erzeugung grüner Energien. Über 30 Prozent geben an, dass es zwar derzeit noch keine konkreten Pläne hierzu gibt, der Aufbau einer eigenen grünen Infrastruktur jedoch als Option für die Zukunft erwägt wird. Diese Zahlen sind ein deutliches Zeichen an die Politik, auch die hohe Nachfrage energieintensiver Industrien, die derzeit nach wie vor einen großen Teil der deutschen Wirtschaftskraft ausmachen, stärker zu berücksichtigen.

Downloads