California Slashes Compensation for Small-Scale Solar

By Christian Roselund

On 15 December 2022 California regulators voted to overhaul the state’s compensation structure for small-scale solar, sharply reducing financial returns for new PV system owners. Solar industry advocates warn that the Net Billing Tariff, which is known colloquially as Net Metering 3.0, will cause irreparable harm to the state’s solar market.

The primary change under the Net Billing Tariff is a shift in compensation for electricity exported to the grid by rooftop PV systems to an “avoided cost” calculation based on wholesale rates, instead of the higher retail rates typical for net metering programs. This calculation will be governed by the hour of the day and the month. For example, all rooftop solar customers in a utility’s service area will receive the same compensation per unit of electricity exported between 3 and 4 pm on weekdays in

July 2023.

Reduced Compensation

The California Public Utilities Commission (CPUC) has acknowledged the new rate paid to PV system owners will be lower than the previous export rate. California Solar and Storage Association (CALSSA), which organized protests against CPUC’s Net Billing proposal, estimates that compensation will fall by 75%.

Customers who adopt solar in the service areas of utilities Pacific Gas & Electric Company (PG&E) and Southern California Edison (SCE) during the first five years of the new program will receive an “export adder” to their avoided cost rates to ease the transition to the new system. This adder is not available in the San Diego Gas & Electric Company (SDG&E) service area, as CPUC determined that compensation will remain high enough there.

New PV systems owners will be required to adopt the Net Billing Tariff whereas existing customers will remain under the legacy net metering structure. Unlike an earlier proposal by CPUC, the Net Billing Tariff does not include a per-kW monthly charge on new PV systems. CALSSA describes the removal of this provision by CPUC as a small victory.

Tens of Thousands of Solar Jobs at Stake

CALSSA has warned that The Net Billing Tariff will result in business closures and job losses, and the record of similar changes to net metering policies in other states supports this. Dismantling of net metering policies in Hawaii and Nevada in 2015 resulted in declines in both market and reduced employment, with the number of solar jobs falling 15% in Hawaii and 22% in Nevada in 2016.

Nevada reversed course and re-instated net metering 18 months later, and state solar employment subsequently rose in 2017. Hawaii held firm and the state’s solar employment fell another 22% in 2017, with the longer-term impact unfolding as a shift in the market to solar plus storage.

CALSSA concerns are noteworthy, with Solar Jobs Census reporting California’s solar industry represented 75,712 of the United States’ 255,037 solar jobs in 2021. Consequently, if California experiences a proportional number of job losses to those in Hawaii or Nevada in 2016, this would affect more than 10,000 workers.

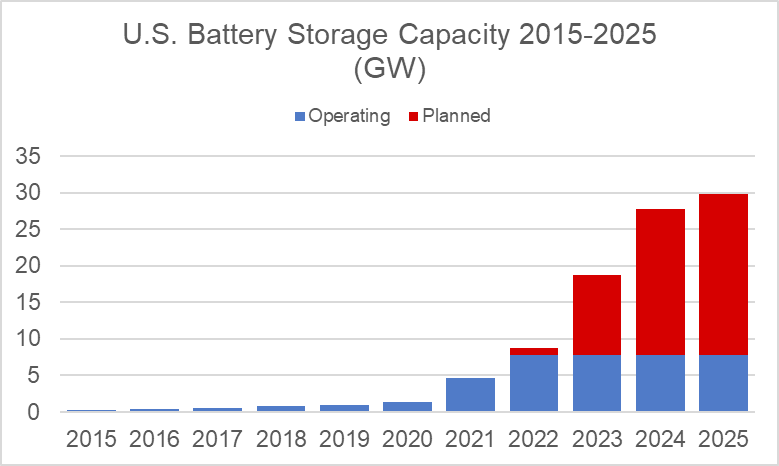

As was the case in the previous “Net Metering 2.0” decision, customers who install a PV system will be required to adopt time-of-use (TOU) rates for the electricity they consume. The combination of TOU rates and a shift to avoided cost incentivizes PV system owners to either self-consume the electricity their PV systems generate, or to export it during evening hours when demand is highest. These use cases are best enabled by pairing battery storage with PV systems.

CPUC anticipates NEM 3.0 will drive an increase in solar plus storage installations, and while CALSSA agrees that it will cause customer who install PV to pair it with batteries it warns that the Net Billing Tariff could result in a reduction of the overall volume of solar-plus-storage systems deployed in California. Indeed, the organization expects the larger solar market to contract as well due to longer payback periods for solar PV systems, even those with battery storage. “With high costs, supply chain constraints, inflation and permitting and interconnection delays and challenges, it will take years before the storage market can match the solar market,” warns CALSSA.

The adoption of the Net Billing Tariff decision starts the clock on a 120-day “sunset period” during which customers can install PV systems and still apply for interconnection under the previous rules. Within one year of the decision (15 December 2023) utilities must have their systems in place to begin enrolling customers under the new rules.

Source: Decision Revising Net Energy Metering Tariff and Subtariffs (CPUC)