IRA to SuperCharge Canada’s Battery Value Chain

By Anjali Joshi

The U.S. Inflation Reduction Act (IRA) is expected to boost multiple EV battery-related sectors in Canada, ranging from exploration & production of critical minerals like lithium, cobalt, and graphite, to EV manufacturing. Under the IRA, consumers who buy EVs can access a US$7,500 tax credit for new EVs and US$4,000 tax credit for used vehicles, but only if EVs meet certain criteria. First, the IRA requires 40% of an EV’s battery metals to be produced in North America, or from countries that have a free-trade agreement with the U.S. This percentage will increase to 80% by 2027. Second, 50% of the battery components: anode, cathode, electrolyte components, and modules need to be made in the United States. This will rise to 100% by 2027. Finally, these vehicles must be assembled in North America.

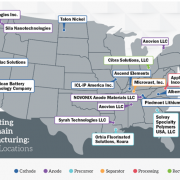

This is a welcome news for Canada who is receiving a lot of investments across the EV battery supply chain. In August 2022, Volkswagen AG and Mercedes-Benz Group signed cooperation agreements with the Canadian government to secure access to battery materials, including lithium, nickel, and cobalt. In July 2022, Umicore announced its plans to invest US$1.5 billion to build a cathode active battery material (CAM) and their precursor materials in Ontario. South Korean company POSCO Chemical is also planning to open a CAM production factory in Canada to supply General Motors.

The Canadian government is also introducing incentives and measures for the development of the domestic EV battery supply chain. Canada is home to North America’s only battery-grade cobalt refinery, which is owned by Electra Battery Material (formerly known as First Cobalt Corp.). Electra Battery Material recently received a CA$5 million investment from Canada’s Federal government, CA$5 million from Ontario’s provincial government, and a loan commitment of CA$45 million from Glencore to refurbish and reopen the refinery. In October 2022, Nouveau Monde Graphite entered into an agreement with Mitsui & Co. and Panasonic Energy to develop its ore-to-battery-market integrated graphite project in Québec.

The localization of EV battery supply chain has become a focal point for Western countries. This helps to reduce their reliance on other countries, especially China and Russia, where there are national security concerns. Canada has also recently taken a major action to remaining on the same page as the United States and reduce China’s dominance in the global battery supply chain. Canada and the United States finalized a Joint Action Plan on Critical Minerals Collaboration in January 2020.

Additionally, on 28 October 2022, the Government of Canada released a policy providing more additional clarity about the applicability of the Investment Canada Act (ICA) to investments in Canadian entities and assets in critical minerals sectors from foreign state-owned enterprises (SOEs). The policy indicates that SOEs in Canadian critical mineral sector will face high levels of scrutiny under the country’s foreign investment review regime. Under the authority of the ICA, Canada recently ordered three Chinese companies to divest their investment from Canada’s mining companies due to national security concerns. The three companies – Sinomine Rare Metals Resources Co Ltd., Chengze Lithium International Ltd., and Zangge Mining Investment (Chengdu) Co Ltd. – are required to divest their investment within 90 days from November 3, 2022.

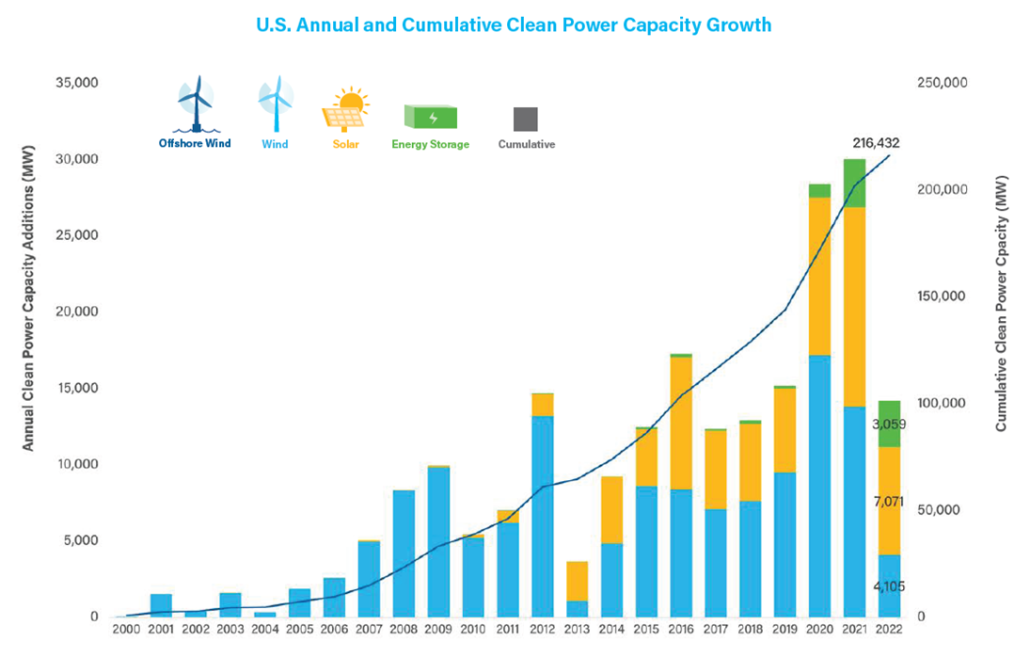

CEA expects the IRA to be an unprecedented driver of Canada’s EV battery supply chain. We expect more capacity expansion plans and investment, both public and private, as battery makers are not only focusing on meeting the IRA bill requirements, but also looking to shorten the EV battery supply chain for EV makers in the North American region.

Source: CEA Research