U.S. Clean Energy Jobs Increased in 2021

By Christian Roselund

The United States gained jobs in solar, wind, battery storage, electric vehicles, and transmission and distribution grids in 2021, according to a report by the U.S. Department of Energy. The U.S. Energy and Employment Report shows that while wind, battery, and electric vehicle jobs grew in both 2020 and 2021, the growth in solar and transmission and distribution jobs in 2021 was a recovery after a fall from 2019 to 2020. Wind, batteries, and electric vehicles are outliers against the larger trend of almost all energy sub-sectors and the larger economy losing jobs in 2020 and recovering in 2021.

Off all the clean energy sectors solar has the most jobs, with an estimated 334,000 in 2021. It is also the largest employer in electric power generation, at 39% of jobs in this sector. The U.S. solar industry added 24,000 workers in 2021, a 5.4% increase and the largest percentage of any form of electricity generation. However, the industry has still not returned to the levels of employment seen in 2019.

By contrast wind jobs enjoyed their second straight year of growth, reaching 120,000 jobs in 2021. The combined 454,000 jobs in solar and wind is much larger than the 123,000 jobs in coal mining, transport, and electricity generation, but still smaller than the 747,000 workers in the nation’s oil and gas industry, including in electricity generation from these sources. In both solar and wind construction jobs are by the largest sector, followed by professional services and then manufacturing.

Electric vehicles and plug-in hybrids together represented 168,000 jobs in 2021. This is a much smaller number than the U.S. jobs in gasoline and diesel motor vehicles, which was 1,983,000 in 2021. However, while gasoline and diesel motor vehicle jobs haves still not recovered to 2019 levels, EV and plug-in hybrid jobs grew in both 2019 and 2020.

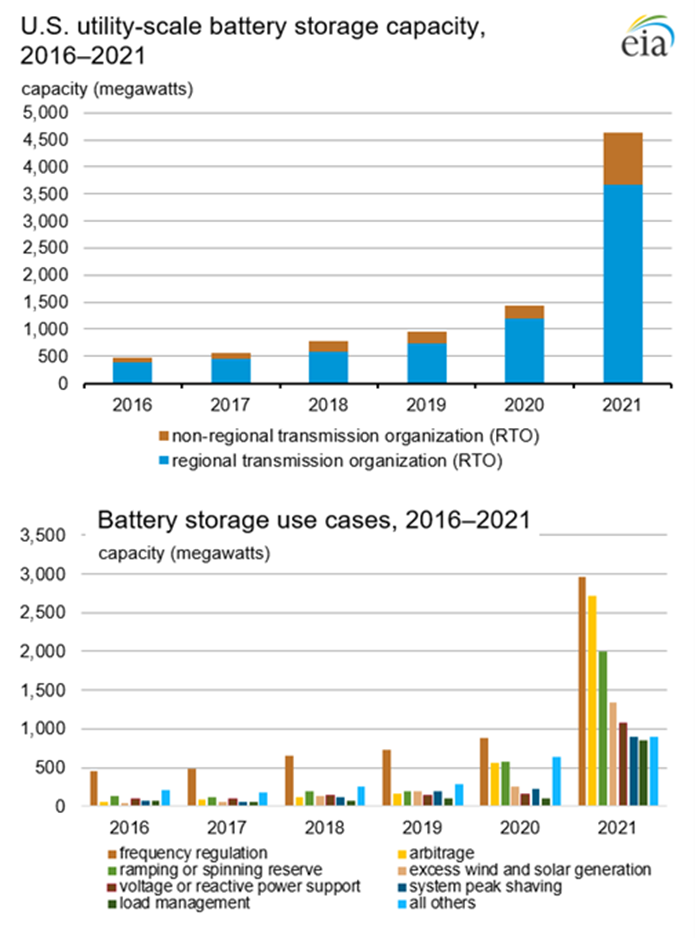

Battery storage also saw its second year of job growth, to reach 70,000 workers.

As is the case with the larger energy industry, in the solar, wind, battery and grid, and motor vehicle industries both women and Black Americans are under-represented compared to the U.S. workforce as a whole. In response to the gender dynamics, several U.S. women’s clean tech organizations have emerged to provide networking and mentorship for women in these industries and address the gender imbalance.

Gender equity has become an area of active attention in the solar industry, particularly at trade shows. This including shaming of companies who hire models as “booth babes” and use sexist displays and advertising, as well as efforts to ensure that panels of speakers are not all-male “manels.” And while women make up only 30% of the U.S. solar workforce, this is still higher than the energy sector as a whole, where only 25% of workers are women.

Source: United States Energy & Employment Report 2022 (U.S. Department of Energy)