FEDERAL CLEAN ENERGY BILL MOVES FORWARD IN THE SENATE

UPDATE: On Sunday, 7 August, the U.S. Senate passed the Democrats’ $740 billion bill, including $369 billion for clean energy and climate and an additional $60 billion dedicated to environmental justice. Analysts calculate that the legislation’s measures will cut 24 tons of greenhouse gas emissions for every 1 ton the bill’s fossil-friendly sections permit.

By Christian Roselund

On 4 August U.S. Senator Krysten Sinema (D-Arizona) announced that she would support the Inflation Reduction Act, the bill that contains multiple clean energy tax credit provisions and would invest $369 billion in climate mitigation. Following a deal reached with Senator Joe Manchin, Sinema has been seen as the most likely holdout in the Democratic Party, and E&E News states that with her support the Democratic Party has the 50 votes needed to pass a bill through the

reconciliation process.

As of 5 August, the Inflation Reduction Act (IRA) was still before the Senate Parliamentarian, who is examining it to ensure that all provisions comply with budget procedures. This is necessary for the bill to qualify for the reconciliation process, which means that it cannot be stopped by minority of Senators using the filibuster technique of obstruction. According to E&E News, Senate Majority Leader Chuck Schumer plans to hold its first procedural vote on the Inflation Reduction Act on

6 August.

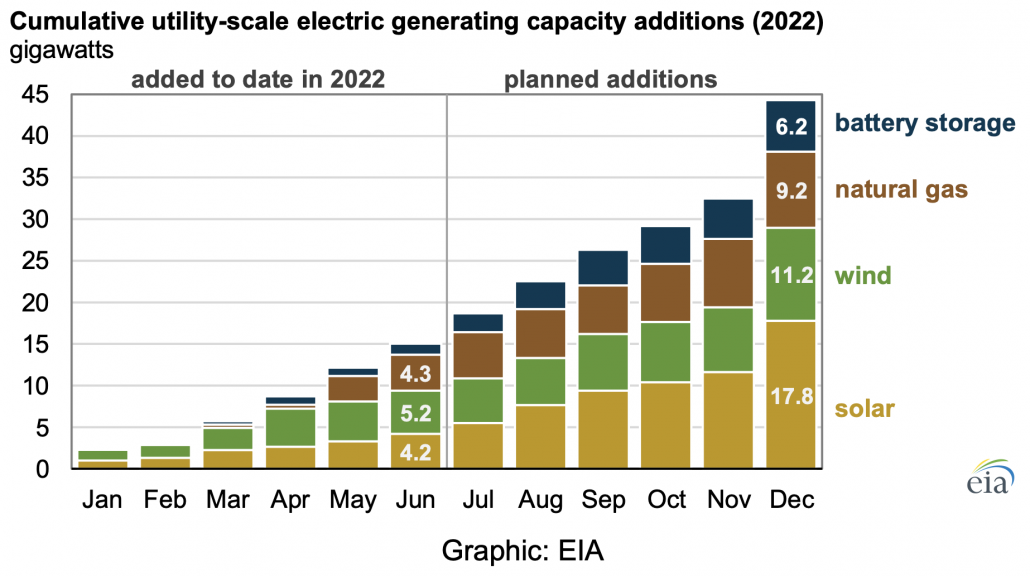

As reported in a special edition of the U.S. Energy Transition Report, the IRA includes an extension of the Investment Tax Credit (ITC) at 30% for solar projects that begin construction through the end of 2024 and allows standalone energy storage to claim this credit. It also extends a 10-year Production Tax Credit (PTC) for wind at $15 per megawatt-hour, adjusted for inflation) for projects that start construction through the end of 2024, and allows solar projects to access this credit. Accessing these credit levels requires meeting labor standards, and after 2024 both are replaced with similar but technology-neutral versions of the ITC and PTC credits for projects that start commercial operation through 2032.

In addition to the ITC, PTC, and technology-neutral ITC/PTC, the bill also includes extensive manufacturing tax credits to support domestic production of solar PV modules, wind turbines, and batteries. This includes specific tax credits for multiple steps of the supply chain for these technologies.

News coverage: Senate approves climate, budget reconciliation bill (E&E News)

Analysts See More Wins for Clean Energy Than Gifts for Fossil Fuel Business (Inside Climate News)

Sinema strikes deal on reconciliation; Schumer sets vote (E&E News)